Flexible Spending Account Rules 2025. The health care (standard or limited). Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to take advantage of an fsa during 2025.

Throughout the year, taxpayers can use fsa funds. On october 22, 2024, the irs released rev.

Flexible Spending Account Rules 2025 Images References :

Source: www.moneycrashers.com

Source: www.moneycrashers.com

What Is a Flexible Spending Account (FSA) Rules & Eligible Expenses, Flexible spending account contribution limits are set annually by the irs.

Source: www.pinterest.com

Source: www.pinterest.com

What is a flexible spending account? Accounting, Flexibility, The irs announced the 2025 contribution limits for all flexible spending account (fsa) plans.

Source: theadvisermagazine.com

Source: theadvisermagazine.com

Tax Benefits of Flexible Spending Accounts, If you wear prescription sunglasses, you may be eligible to pay for them with fsa money.

Source: studylib.net

Source: studylib.net

Flexible Spending Accounts, The health care (standard or limited).

Source: www.pinterest.com

Source: www.pinterest.com

How do I contribute to my FSA? Vision insurance, Contribution, Ways, If you would like to adjust your.

Source: www.slideserve.com

Source: www.slideserve.com

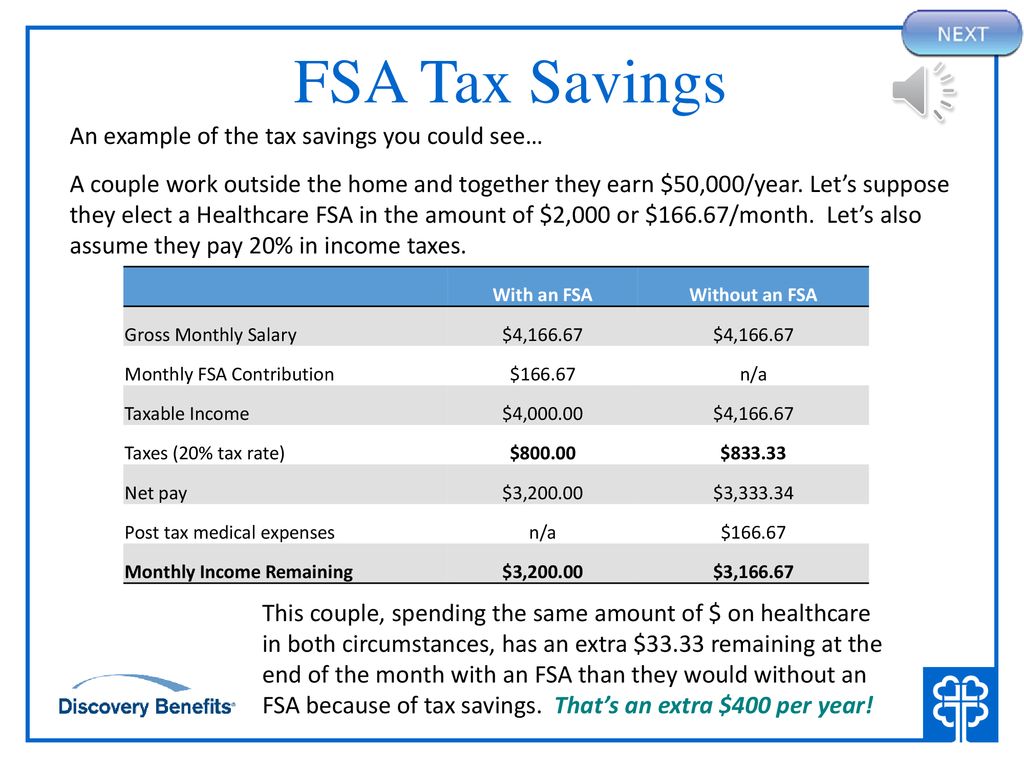

PPT Flexible Spending Account PowerPoint Presentation, free download, Plan your spending, know the rules and unlock amazing tax savings.

Source: www.hrmorning.com

Source: www.hrmorning.com

Flexible Spending Accounts Communicate these 4 things, These limits undergo annual adjustments to.

Source: slideplayer.com

Source: slideplayer.com

Flexible Spending Accounts (FSA) To proceed to the next slide, click, 8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may be.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Health Savings vs. Flexible Spending Account What's the Difference?, A health flexible spending account (fsa) is a workplace account you can use to pay for certain medical costs that come out of your own pocket, such as insurance copays, prescriptions and.

Source: skpadvisors.com

Source: skpadvisors.com

Use Flexible Spending Account by YearEnd SKP Accountants & Advisors, LLC, Learn how they work, contribution limits, and the.